From Jeff Bezos’ hopes of cementing India as Amazon’s second strongest market after the US, to the record-breaking sales generated by Alibaba during China’s Singles Day, the increasing number of newly connected consumers in APAC present unmissable growth opportunities for online commerce. And, as we outline here, it’s mobile which is key to the future growth of APAC’s commerce.

1. M-Commerce is Now Mainstream in APAC

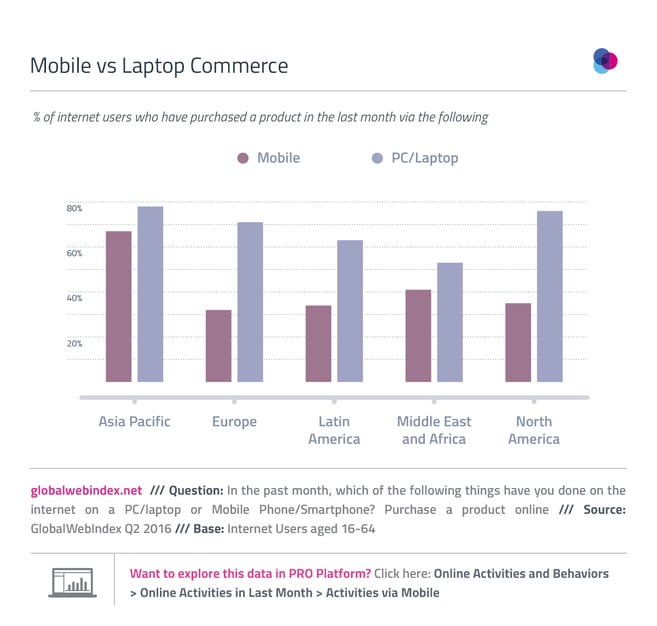

The fundamental role played by mobiles in the formation of the internet landscapes within APAC – where smartphone ownership now outscores PC/laptop ownership – has made these devices the key driving force behind internet uptake in this region. Aided by cheap mobile handsets, digital consumers in APAC are now around 2x as likely to be engaging in m-commerce as in most other regions. For many new digital consumers in this region, mobiles will be the default device for online shopping.

2. Internet Users in APAC are Young and Mobile-First

A key characteristic among the fast-growth markets of APAC is their predominantly young populations which also tend to skew urban and affluent. In fact, APAC alone constitutes 65% of the global online millennial audience, with millennials in Malaysia (68%), India (65%) and China (64%) composing the lion’s share of the online populaces in these markets.

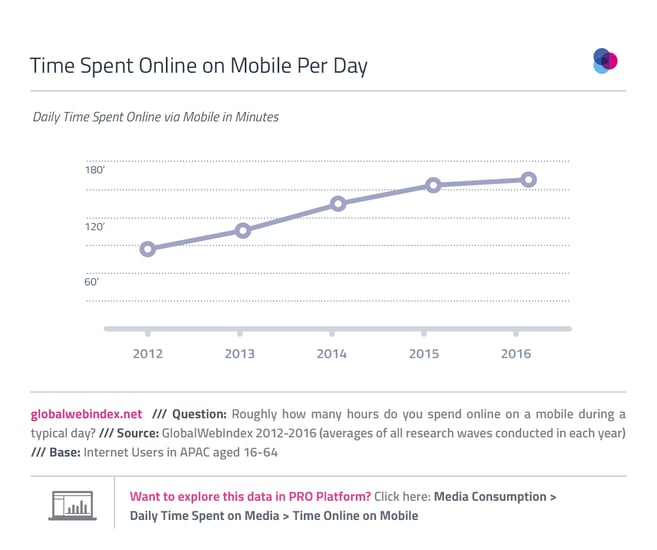

And mobile is key to the commerce activities of these young consumers – they are 45% more likely to cite mobiles as their most important device for getting online (6 in 10 do) and most importantly they are 37% more likely to be purchasing products online via their mobile (over 7 in 10 are). But perhaps most telling is how long these consumers are spending online on mobile each day – clocking up an average of 2:41 hours each day, up from 1:26 hours in 2012.

3. Mobile Networking Will Drive Social Commerce

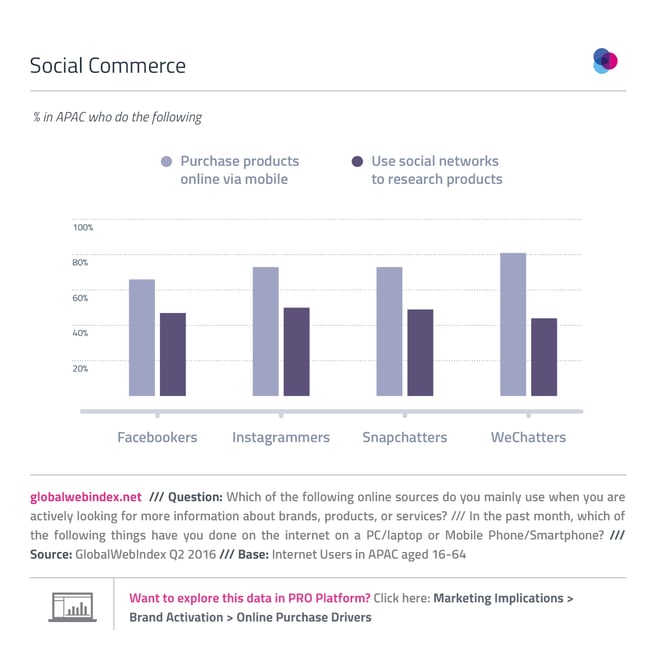

The nature of smartphone usage means that these mobile-first consumers in APAC are increasingly able to dip in-and-out of social networks whenever and wherever they like via their mobiles, even if it is for short periods of time. So as social networks strive to incorporate more and more activities inside their platforms – and as behaviors continue to migrate to mobile – we’ll see the commerce space within these networks open up even further.

After all, it’s already 8 in 10 WeChatters engaging with m-commerce each month, with 3 in 4 Instagrammers and Snapchatters, as well as 2 in 3 Facebookers doing the same. Meanwhile, around half of engagers across these networks in APAC are researching products via social networks; it doesn’t seem too farfetched to assume that this is fertile ground in the future of commerce in this region.