You’re never going to make an ad that doesn’t trigger someone.

Our data shows that 38% of global consumers block ads regularly or occasionally. 61% say they feel there are too many ads, and 54% say they get in the way.

Despite all this digital ad spend is growing, because getting it right gets results.

Digital ad spend is forecast to reach $423 billion by the end of 2023, which means it’ll account for 58.3% of global programmatic ad spend.

All of which puts programmatic ad buying in the spotlight, so let’s dive in and explain the key things you need to know. We’ll run you through:

- What programmatic ad buying actually is

- How the death of the cookie will impact programmatic ad buying

- Why the future of programmatic ad buying is integration

- 5 neat examples of brands nailing programmatic ad buying

- 5 tips on how you can ace your programmatic advertising efforts

What is programmatic ad buying?

Put simply, programmatic ad buying – sometimes called programmatic advertising – is when media buying (aka buying ad space) is made more efficient through the use of automated tech. The alternative is a manual, traditional buying method.

Programmatic ad buying is the sweet spot where cutting-edge tech meets consumer data, with algorithms serving adverts to users at the right place and time, and for the right price. How relevant the result is depends on the quality of insights you start with.

How does programmatic advertising work?

The nuts and bolts can be a little complicated, not least because there’s a ton of jargon that goes with it. Here’s how Marketing Week boils it down:

“Put simply, brands or agencies use a demand-side platform (DSP) to decide which impressions to buy and how much to pay for them, while publishers use a supply-side platform (SSP) to sell ad space to brands. These two platforms are then matched up in real time.”

The three types of programmatic media buying

There are three main ways you can go about programmatic media buying:

- Real-time bidding (RTB): This happens in real time and is considered a cost-effective way to buy ad space if you want to reach a large audience.

- Private marketplace (PMP): Similar to real-time bidding, but with certain rules around who can get involved. Sometimes advertisers can apply to take part and then undergo a selection process, or join on an invite-only basis.

- Programmatic direct: This is when you skip the auction part, and a publisher just sells directly to one or more advertisers at a fixed cost per mille (aka “cost per thousand impressions”, often abbreviated to CPM).

How the death of the cookie will affect programmatic buying

Ad gurus around the world are already coming up with new and inventive ways to bypass cookies.

Roman Vrublivskyi, head of SmartHub white label ad exchange, says, “2023 will be a banner year in the development of programmatic advertising. As the world finally wakes up after the pandemic and technologies evolve, there’ll be exciting discoveries and unexpected conclusions. However, we can already predict many changes, so be prepared for them.”

According to Vrublivskyi, these include:

- Automation: With machine learning and AI developing at such speed, more brands are using new tech to save time and resources while marketing, and during the bidding process.

- Digital out-of-home advertising: With the ability to tailor ads to the time of day, the weather, and tentpole moments in your industry’s calendar, it’s no surprise that interactive ad media can achieve a 100% better conversion rate compared to static media ads for digital out-of-home advertising.

- Digital audio ads: In the context of an attention recession and screen fatigue, audio of any kind is gaining popularity among advertisers and marketers. Spotify reported a 17% year-over-year growth in ad revenue in Q1 2023.

- Rewarded ads in games: Gaming ads are a great tool for connecting with consumers – especially when they’re targeted and offer an incentive like in-game currency, extra lives, or a power-up.

The future of programmatic is integration

Buying targeted ads via digital platforms relied heavily on third-party cookies, but with cookies on their way out, technology platforms and their partners are finding new, privacy-safe ways to deliver targeted advertising.

One thing is already clear: you’re going to need more data.

And the only way to get that is by integrating with third-party syndicated data sources.

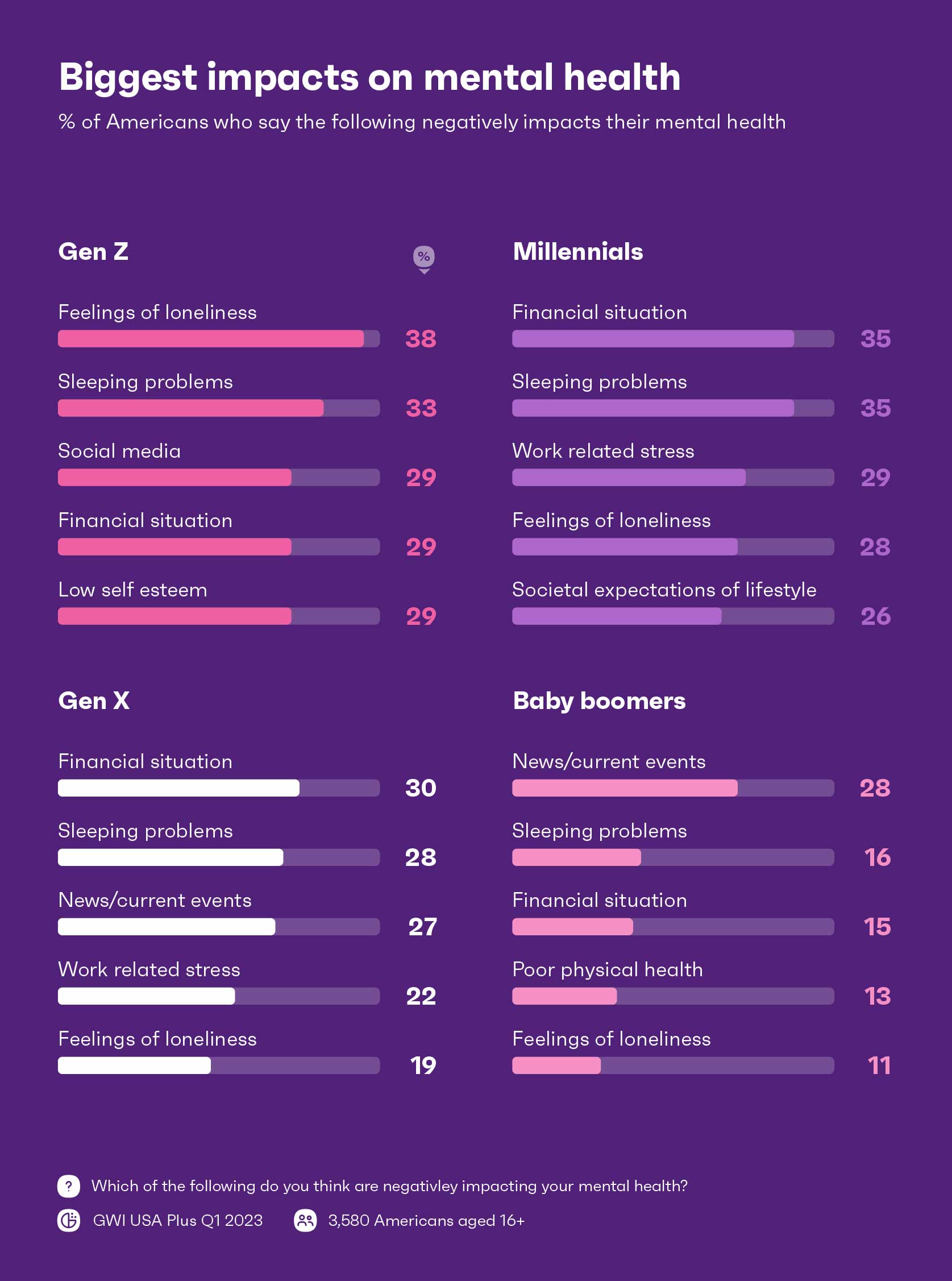

Here at GWI, we’re working with ad platforms to help supplement their bidstream (or SSP) data. They can pull out attitudinal insights on specific generations like Gen Z and baby boomers, or explore the purchasing behaviors of, say, male car buyers – adding color and detail to their picture of target audiences.

Not only can you use GWI to see how people are accessing the internet to buy products – information you can use to optimize your choice of channels across desktop, mobile, and tablet – but you can also see what people are buying.

We’re arming ad experts with everything they need to succeed – from planning and line item strategy, to ad campaign building.

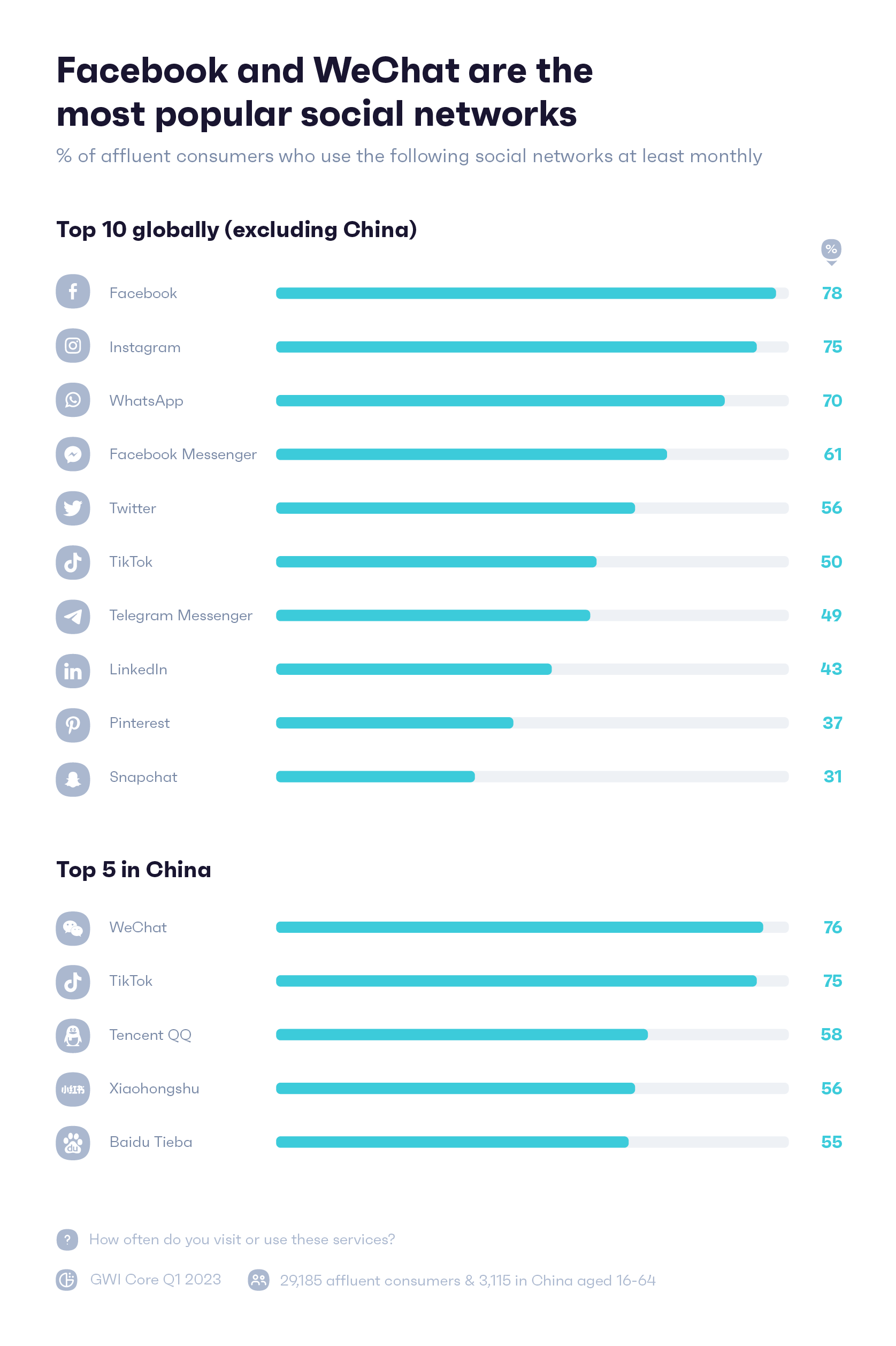

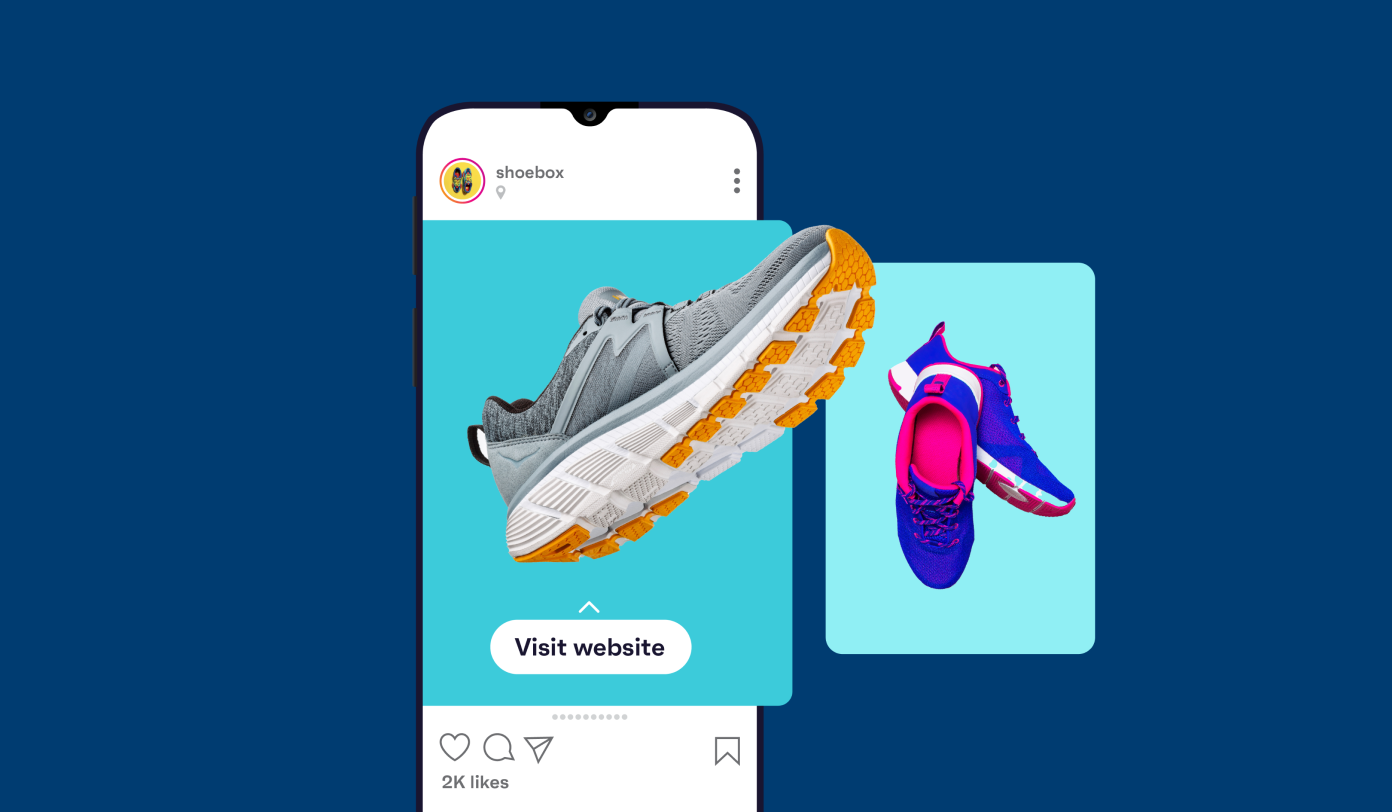

We also have a privacy-safe integration into digital ad platforms including Facebook, Instagram, Google, TikTok, and more.

In this integration, a GWI user can map audience(s) of interest into Facebook segments, and then push those segments back into Ads Manager to run highly-targeted advertising campaigns on Facebook, Instagram, and other Meta properties, directly against their original target audience.

By matching GWI attributes with Facebook (Meta) segments, we remove the need for ad targeting based on third-party cookies, ensuring privacy-by-design and effective targeting.

5 brands getting programmatic ad campaigns right

1. The Economist

2. Lacoste

3. Turner Sports

4. Audi

5. The Amanda Foundation

1. The Economist mirrors its audience

The Economist wanted to target ‘intellectually-curious’ readers who’d previously been reluctant to try the publication.

They started by tapping into their wealth of subscriber data to identify the most relevant and engaging content to deliver, tailoring stories to their audience.

This included analyzing web and app usage of subscribers to the journal, and identifying reader preferences (like what type of content was consumed and when). They also married up cookie, subscriber, and other wider data sets to build seven segments reflecting the publication’s key sections:

- Finance

- Politics

- Economics

- Doing good

- Careers

- Technology

- Social justice

From there, The Economist team created lookalike audiences to guide who they wanted to target with programmatic ad buying. Web page context and viewer profiles were assessed in real-time, enabling the brand to serve an appropriate ad to each consumer.

The ads were linked to The Economist’s content hub, presenting a relevant article and inviting the user to subscribe. More than 60 executions were created, many in near real-time, from the company’s live newsroom.

The results were remarkable, generating 650,000 new prospects, with 3.6m people taking action after seeing the ads. The campaign ROI was 10:1 on a £1.2m media budget.

In the US, where The Economist is less well-known, ‘awareness’ jumped 64%, ‘consideration’ rose by 22%, and ‘willingness to recommend’ rose by 10%.

2. Lacoste hits some stunning figures

The world of online fashion is particularly competitive. Lacoste, however, proved it’s not always about who has the ‘cleverest’ digital marketing on social media – instead, it’s about getting the basics right.

Summer is peak time for the clothing brand, and the team wanted to focus on driving sales in three markets – France, the UK, and Germany – using targeted programmatic advertising.

Digging into the consumer data they had at their disposal, they segmented their audiences, targeted them, then retargeted them using a range of placement and creative options.

This is pretty standard stuff for any solid programmatic campaign; the real point of difference was the way Lacoste used A/B testing.

With a significant budget invested in trialing different banner formats, channels, and daily ad spend, they tweaked, refined, and optimized their campaigns until they were sure they were getting the most out of every single ad.

The result was nearly 20 million brand impressions, and a total of 2,290 sales across their chosen target markets.

3. Turner Sports increases ad recall

Turner Sports wanted to extend the reach of the NBA’s Season Tip-Off events, which are aired on Turner’s US cable channel, TNT.

The company worked to build audience lists based on previous AdWord campaigns, before using Google Marketing Platform to identify the most relevant audiences.

The brand then gathered real-time video from Tip-Off events (including shots of fans and athletes) across the country before launching a programmatic video advertising campaign. The content was delivered as YouTube TrueView ads to six million unique viewers across the US.

The campaign complemented Turner Sports’ live broadcasting, amplifying the story around the NBA Season Tip-Off events to optimize their marketing impact.

The activity drove a 17% lift in ad recall and a 7% lift in brand awareness for the NBA on TNT.

4. Audi gets personal, in a good way

The Audi Q2 is a customizable, luxury crossover SUV, so it’s no surprise that Audi wanted to make a big splash for its launch. And that splash needed to be personal.

The bar was high. Audi wanted a campaign that matched its own brand slogan, ‘Vorsprung durch Technik’, broadly translated as ‘Advancement through technology’.

Audi worked with Google to join the dots and analyze its key touchpoints related to analytics.

Jason Lusty, head of marketing in Germany for Audi AG, explains, “One of the biggest challenges that we have, as I think most marketers have at the moment, is that the data is still living in silos.”

Data included floodlight tags (or image pixels) on the Audi site, enabling the creation of retargeting lists of previous website visitors, as well as in-market segments. This helped Audi discover new users whose online behaviors showed their intention to make a car purchase.

A car configurator on Audi’s site gave customers the chance to digitally customize their dream car, letting Audi collect information about users’ style preferences in the process. These insights were then used to drive dynamic ad creatives.

A customer’s position in the sales funnel, along with their style preferences, guided which ad they would be served, ensuring it was always super relevant, personalized, and eye-catching for that particular consumer.

Buying ads programmatically led to an average conversion rate four times higher than those bought traditionally, while the campaign’s creative ads were twice as efficient as standard ads.

5. Amanda Foundation does something a little different

A great example of a brand taking programmatic in a new direction is the non-profit organization, Amanda Foundation, which partnered with Saatchi & Saatchi to create a super personalized programmatic campaign.

‘Digital Pawprint’ is all about matching people with animals up for adoption in the charity’s shelters, based on their hobbies and characteristics.

Chris Mead, one of the brains behind the campaign, said, “Pets are proven to improve quality of life, but they aren’t one-size-fits-all. Factors like age, activity level, and family status mean some animals are a better fit than others.

“Modern display ads use information like a person’s location and browsing behavior to serve them hyper-relevant messages. So Amanda Foundation decided to use the same data to serve that person a hyper-relevant pet.”

Amanda Foundation used programmatic advertising to essentially “play matchmaker”. The result was a striking campaign, fully targeted and personalized, which showed the potential of programmatic advertising to support good causes.

Programmatic ad buying fundamentals

It’s not about how you divvy up your digital advertising budget, but about what you leverage to back that up.

You need to know who you’re targeting – on an emotional level – so you can be sure it’s okay to reach them at that particular moment. As these brand examples show, solid consumer insight underpins any successful campaign because it gives you those very answers.

How you get that insight, and what you do with it, is what makes the difference.

How to nail your programmatic ad campaigns

1. Know enough about programmatic tech

You’ve got options when you’re buying programmatically, and the choices you make have an impact. Keeping on top of emerging trends in this space is key. You need people who know the tech side, and you need them to get to your target audience – not at surface level, but in detail.

2. Put consumer insight in the driver’s seat

To make programmatic work, it takes more than a reliance on web analytics that track cookies or devices – especially with cookies on their way out. Brands need survey data that reflects real people to find out the customer touchpoints that matter and know what their audience’s priorities are.

GWI is home to the world’s largest study on the digital consumer, giving brands easy access to the insights they need without endless digging.

3. Add your first-party data

First-party data isn’t canceled out by survey data. The data you already have on customer behaviors is a valuable piece of the research pie. But it only gets contextualized – and you only see the full picture – when you’ve got consumer motivations and attitudes to layer it with.

4. Don’t sit and wait – optimize

Programmatic advertising leaves lots of room for optimization. It’s automated, so you don’t have to go through people to switch things up. If you need to tweak your messaging, ad placement, or frequency, you can. How do you know if you’ve got the advertising mix right for your audience? You pair real-time analytics with what people are saying, and keep evaluating.

5. Measure your campaign effectively

In a fast-paced consumer landscape, brands need to ensure no budget is wasted and identify where to focus their efforts next time around. There’s no escaping ROI – greater scrutiny of budgets brings greater accountability.

Track the effectiveness of your campaign from start to finish with the same combination of analytics and survey data. And if you want, you can probe further with tailored studies that assess your impact on real people.