“Yesterday, everybody smoked his last cigar, took his last drink, and swore his last oath,” wrote Mark Twain in a diary entry on 1 January 1863.

Even in the 1800s, many people were embracing January 1st as the date to have a fresh start.

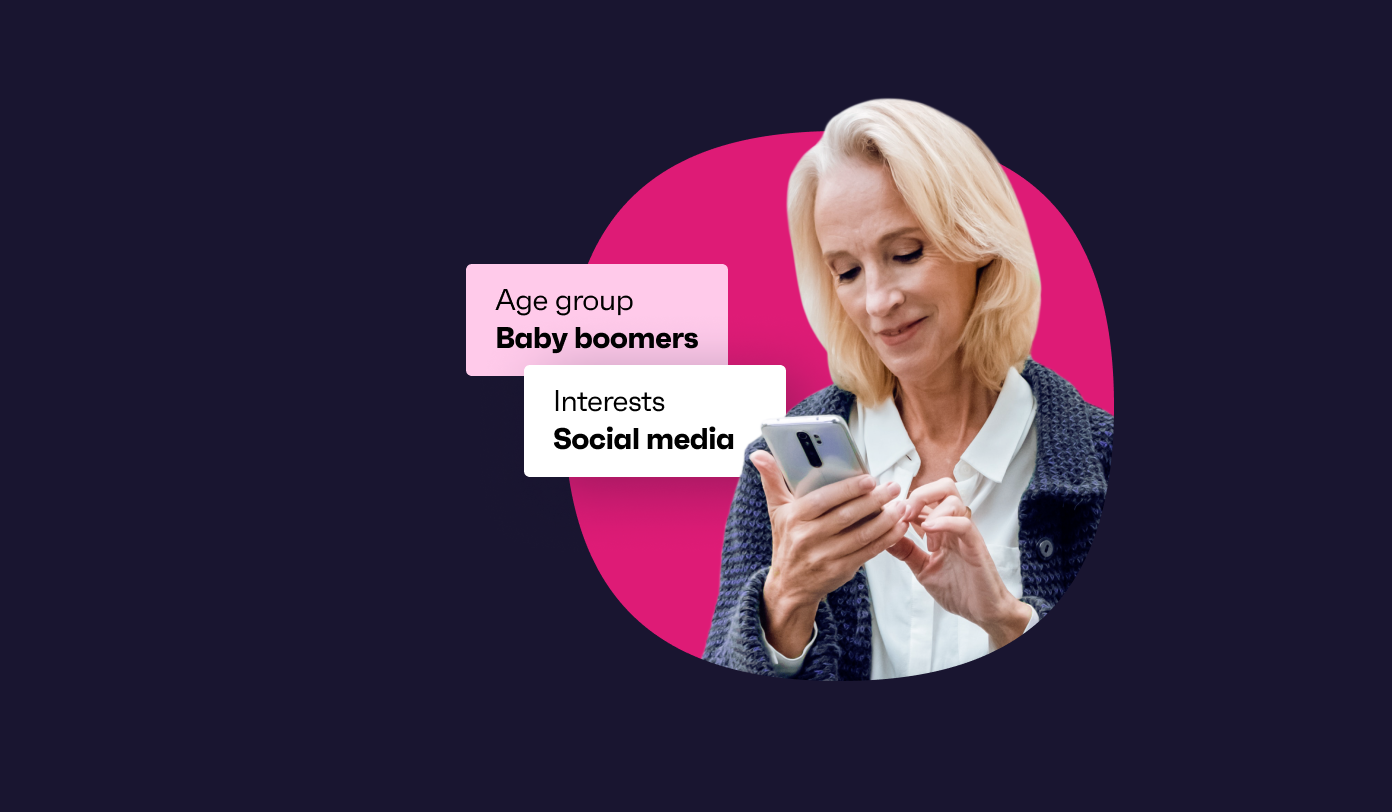

Today, the appeal of making a to-do list for self-improvement is very much still there. Our research shows a good two-thirds of consumers are taking the opportunity to make changes this year – a figure driven largely by younger folks.

While not everyone buys into the “New Year, New Me” mentality, New Year’s resolutions offer up some helpful insight into consumers’ frame of mind and what their priorities are for the year ahead.

It’s about starting, not stopping

Traditionally, New Year’s resolutions have often been associated with doing less of something or stopping it altogether. A bit like Mark Twain and his cigars. We’ve all likely made some of these “cutting out” resolutions in the past, and probably found them extremely difficult to stick to.

There’s a good reason for that too. Large-scale research carried out by scientists in Sweden showed that these “avoidance” type resolutions just aren’t as sticky as “approach” goals. Essentially, adopting a new habit has higher success rates than stopping or avoiding something.

This feel-good, reward-based approach is something that people are embracing more of in our own research.

Using our Zeitgeist research from November, the top 5 resolutions people plan to make for 2022 are all around doing more of something or learning something new, such as eating healthier, learning a new skill, or spending more time with family or friends.

The bottom 5 resolutions are equally telling. Most of them are avoidance-type behaviors such as eating less meat, drinking less alcohol, or watching less TV.

Veganuary, which is gaining more momentum in the UK and starting to catch on in the U.S., isn’t necessarily the food-eliminating challenge it once was. More mainstream brands are bringing vegan and plant-based alternatives into the hands of consumers, making it easier than ever to make food swaps.

Maybe there would be even greater buy-in from consumers if the goal of “eating less meat”, for example, is reframed to “eating more plant-based alternatives”. So, rather than thinking about what you take away from yourself completely, you think about what you can add. This, in turn, might make it easier for people to stick to beyond the month of January.

This also helps to explain why “losing weight” is much lower down the list of resolutions compared to “eating more healthy food” (28% vs. 57%). Based on the Swedish study, simply reframing a goal could be key in making it stick. Switching the goal from “I will eat less sweets” to “I will eat 3 portions of fruit a day” (or whatever your goals might be) will likely be more successful, because it’s not about avoidance.

For those not making resolutions, 25% think they’re too hard to keep and 21% say they add too much pressure.

This underscores the importance of setting realistic and rewarding goals. It shouldn’t feel like a punishment or chore.

One of the trends in our Connecting the dots report focused on consumers’ focus on purpose and meaning. Ultimately, the pandemic prompted many people to reflect on and reassess their priorities and figure out what makes them truly happy.

People are seeking more from life and embracing a more “YOLO” mentality – a trend that’s mirrored in how people are approaching resolutions.

In the U.S./UK, traveling more has seen the biggest increase among resolution makers.

36% of this group say they want to travel more as one of their New Year’s resolutions, up from 29% in 2020. As covered in ABTA’s research, the “catch-up consumer” is emerging as a trend, where consumers make up for trips and experiences they’ve missed out on during the pandemic.

Globally, optimism about personal finances has grown since last year, reaching 57% in Q3 2021 (up from 49% in Q2 2020). Alongside this, close to 40% of consumers across 7 markets say treating themselves has become more important to them over the past year. Travel brands should really hone in on this increased financial confidence, need for adventure, and desire to splurge.

For brands generally, leaning into consumers’ positive mindset around making healthy, mindful changes is something that’s bound to resonate with those making resolutions (and those who aren’t). For example, fitness or health brands could hone their messaging around the importance of holistic wellbeing, such as the importance and benefits of sleep or exercise, rather than focusing on rudimentary metrics like losing body weight.

More uplifting, inspiring messaging from brands is something that will land better considering the tough couple of years many people have had.

Consumers have their sights set on self-care

Whether you’ve been directly impacted or you’ve seen loved ones struggle, there’s no ignoring the toll the pandemic has taken on our wellbeing.

From our GWI USA dataset, anxiety and stress have both increased over the past year across all generations, affecting younger people the most. In Q3 2021, 34% of Gen Z say they experience anxiety at least occasionally, up from 31% in Q2 2020. Millennials have also seen a 20% increase in stress since Q2 2020.

It’s no wonder then that wellbeing-centric resolutions, like focusing on mental health or practicing more self-care, make the top 5 list for every generation (out of a list of 17 possible resolutions). For Gen Z, focusing on their mental health is the second-most important resolution (53%), behind learning a new skill.

The latter resolution also hints at Gen Z’s “YOLO” mentality as we covered above. There’s a clear desire to upskill and learn something new, which makes a lot of sense considering how much education, social, and work disruption this young group faced during the pandemic. This, in turn, could have positive knock-on effects for mental wellbeing.

This wellbeing trend comes to life more in our Connecting the dots report, where we cover how consumers are proactively looking after their health in new ways and taking ownership of their wellbeing.

Around two-thirds of consumers have become more conscious about looking after their mental health than before the pandemic.

The most meaningful resolutions are the ones that directly or indirectly impact wellbeing. That’ll look different to many people of course. It might mean focusing on achieving better sleep, taking more breaks from work, or even something small like drinking more water.

Technology has also become more central in helping people to manage their health, both personally and in the workplace. A quick glance at the lineup at CES 2022 shows the massive enthusiasm for digital health innovation.

There’s many words that could sum up 2021 for many people, one of them being “burnout”. After almost 2 years of ongoing stress and anxiety, mental health has rightly become a significant focus in the workplace.

Using GWI Work, 47% of professionals want their company to provide more flexible working and 28% want them to provide support services to help employees in the next stage of the pandemic. Many companies ramped up their mental health support during the pandemic, from offering on-demand resources to opening up mental health conversations.

However, previous research shows the stark disconnect between employees and HR professionals about how supportive employers are of their workers’ wellbeing. Going into 2022, it literally pays to make sure your employees are cared for, feel psychologically safe, and have access (and knowledge) of the mental health tools on offer.

Kicking the year off to a (hopefully) better start

New Year’s resolutions may not be for everyone, but for many they act as a starting point for self-reflection and the hope that things can change and get better.

It’s much less about recognizing our downfalls or vices and cutting them out.

It’s about reflecting on what our lives are like, what we’d like to learn, and what might make us even 1% happier each day.

For brands, ensuring messaging and campaigns are positive, motivating, and inspire consumers to look after themselves is important. People have faced restrictions of all kinds over these past two years – now’s the time to ask what we can give ourselves, rather than take away.