So you need an online tool or resource to support your market research and help you understand consumer sentiments – but where do you start? How do you assess the different options? And what even counts as a good tool or resource in the first place?

If those questions sound familiar then relax, we just happen to have the lowdown on 16 market research tools and resources that can help you stay close to your target consumer. Let’s start with a quick definition of what we’re counting as a market research tool or resource.

Market research tools and resources demystified

When it comes to market research, some tools are excellent for end-to-end insights (for example a consumer research platform like GWI), while others are great to dip in and out of to add flavor to your findings. But broadly speaking they all enable businesses to find markets, and/or understand how consumers feel about a product or service.

Common uses for market research tools and resources offered by companies like these include data analysis, social media monitoring, competitor intelligence, and predictive analytics, but that’s far from an exhaustive list.

The big benefit of using market research tools and resources to study a target audience’s perceptions, opinions, beliefs, attitudes, and reactions is that you can make better, more informed decisions based on data rather than intuition or experience.

Must-have features of market research tools and resources

Choosing a market research tool or resource is a bit like hunting for the perfect banana in your local store. It needs to be ripe with features, firm enough to stand everyday handling, yet soft enough to adapt to your needs. While it’s impossible to draw up a definitive list of must-have features, the following is a good start:

Quality and variety

Look for a tool/resource with access to a wide range of reliable information sources and data types, such as quantitative, qualitative, behavioral, and attitudinal. It’s also important to check how fresh the platform’s data is; the more recent, the more trustworthy.

Analysis and visualization

It’s incredibly helpful to be able to analyze and visualize data to identify patterns, trends, insights, and opportunities. It’s an added bonus to be able to slot charts and visuals straight into your pitch decks and proposals.

Integration and collaboration

Compatibility with other marketing tools in your tech stack can be important, as are features to support collaboration with team members, clients, and partners. Look for smart sharing features and other integrations that’ll help you embed the tool into your daily workflow with ease.

Security and compliance

You want a tool that can store and transmit data safely, that allows you to control the access and permissions of the data, and complies with local regulations.

Scalability and affordability

The best market research tools and resources adapt to your changing needs, have a transparent pricing model, and provide a good return on investment. It’s always a good idea to opt for a tool/resource that you can scale up and down in terms of seats, markets, and so on as your business grows.

Simplicity and support

The final thing to consider is the tool/resource’s ease-of-use and the helpfulness of its team. Reliable, friendly customer support can, and often does, make all the difference.

16 must-know market research tools and resources for better consumer insights

1. GWI

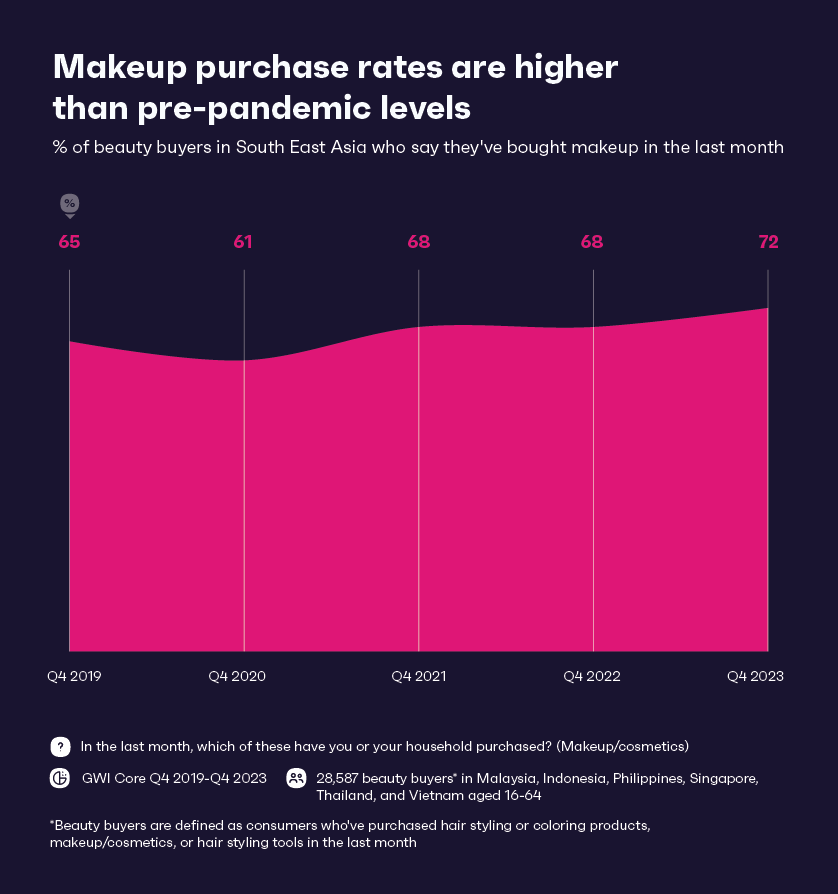

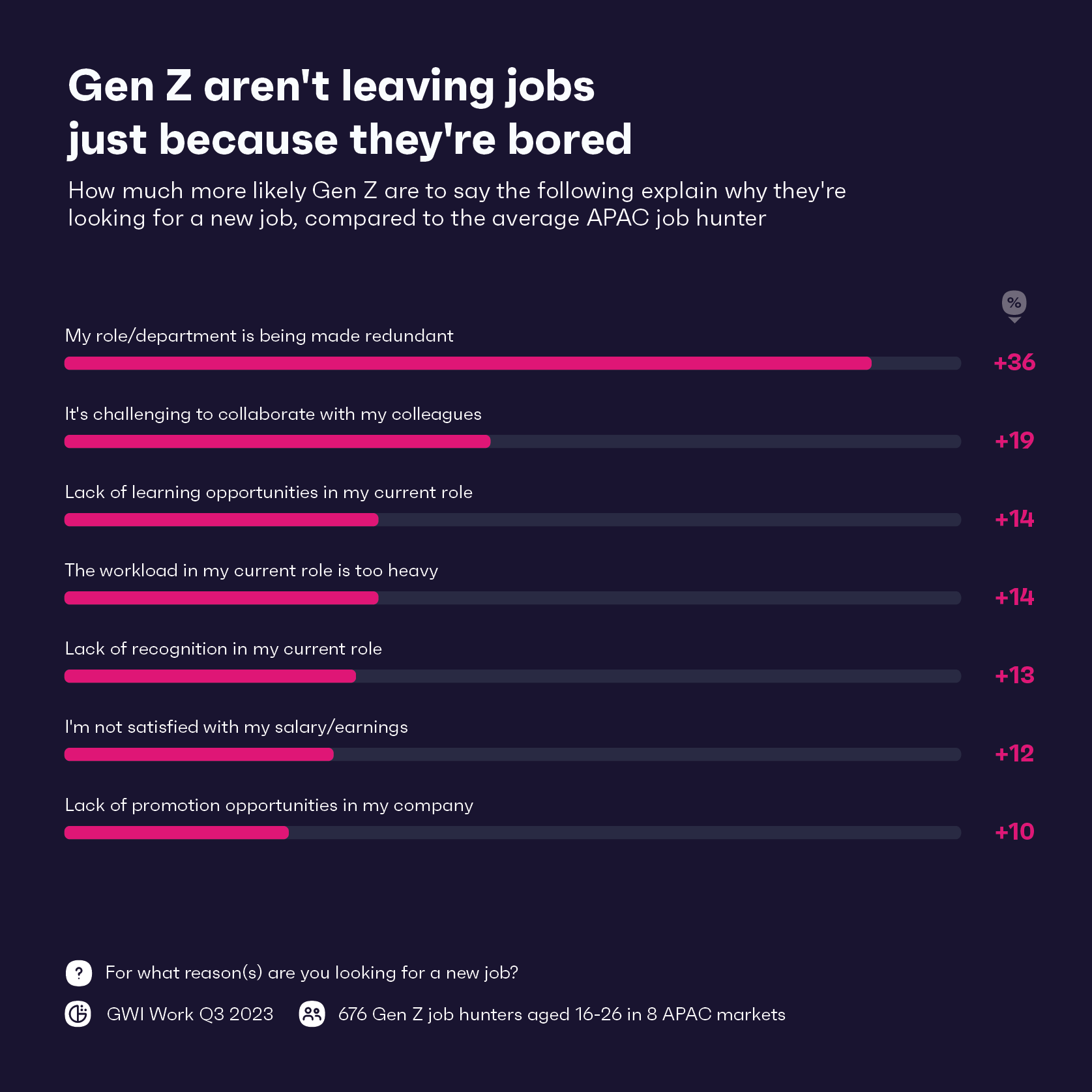

GWI is a global consumer research platform that offers instant access to data on the views, behaviors, and interests of nearly 3 billion consumers in 53 countries.

GWI’s platform is the go-to starting point for organizations large and small when it comes to end-to-end market research – by which we mean finding their ideal audience, getting to know them, and understanding their interests and behaviors. Using that information, organizations can fine-tune their thinking by using other tools mentioned below.

Specialisms

GWI excels in revealing exactly what drives buyers, giving users the answers they need, just when they need them. In addition to our flagship consumer data survey – our specialist data sets cover the US, alcohol, automotive, consumer tech, gaming, luxury, sports, travel, work, kids, and more.

Best for

Fast, intuitive, and powerful end-to-end market research and consumer sentiment tracking.

2. Statista

Statista is a data aggregator, collecting insights from various sources. They provide market, company, and consumer data, operating in 13 locations worldwide and providing statistics and forecasts on 80,000 different topics from 170 industries and 150 countries.

Specialisms

The Statista platform supports market analysis and forecasting, data analysis, product and price research, concept testing, and user experience research. It’s equally adept at tracking, positioning and image studies, advertising and PR analysis, target group profiling, and satisfaction surveys.

Best for

Grabbing quick stats on a wide range of topics.

3. Qualtrics

Qualtrics’ software powers over 1B surveys every year, providing customers with answers to their market, brand, customer, and product questions. Customers can design their own surveys using Qualtrics’ drag-and-drop survey tool, library of 100+ question types, and pre-built survey templates.

Specialisms

Qualtrics divide their offer into six specialist solutions. Contact Center is designed to reduce churn and drive loyalty, Market Research delivers the consumer insights, while CX Professional focuses on the customer journey, uncovering opportunity, and driving organizational outcomes. Human Resources is designed to pinpoint key drivers of engagement, Digital helps users understand the end-to-end experience across all digital channels, while Product Management aims to improve product market fit.

Best for

Designing tailored surveys that get to the crux of what customers think.

4. Google Trends

Google Trends is a good example of a resource that supports market research by giving users a feel for what’s being searched for in which market, rather than being used to perform market research itself. Users can search by geographic location, time frame, and by category for more granular results.

Specialisms

Google Trends specializes in showing what people are searching for, in real time. That data helps Google Trends users measure search interest in a particular topic, in a particular place, and at a particular time. The Google Trends homepage shows what topics are trending right now, enabling users to explore and gauge interest in virtually any topic.

Best for

A high-level view of what’s trending to help gauge interest in a topic.

5. Tableau

Tableau is a visual analytics platform that aims to transform the way people use data to solve problems, empowering individuals and organizations to make the most of their data. Basically, Tableau turns data into insights, using AI to accelerate decision-making and eliminate repetitive tasks. They describe their service as “intelligent analytics at scale.”

Specialisms

As an end-to-end data and analytics platform, Tableau specializes in driving better business outcomes with fully-integrated data management and governance, visual analytics and data storytelling, and collaboration.

Best for

Plugging in a brand’s own data to create visualizations that can aid decision making.

6. Typeform

Typeform allows users to create custom forms, surveys, and polls that collect more and better audience data. Their free plan – incredibly useful for any organization just starting out in market research – enables users to create unlimited forms, access 3,000+ templates, and collect responses.

Specialisms

Typeform – and you might not be surprised to hear this – is all about forms. They specialize in tools that make it easy to build and customize mobile-optimized forms, then embed them where people see them to boost participation.

Best for

Plans start at just £21 so Typeform is great for brands who don’t want to break the bank while gathering insights.

7. Loop11

Loop11 is a UX tool for designers, marketers and product managers that gathers feedback on website experiences and usability, with no coding or usability knowledge required.

Specialisms

Loop11 specializes in user testing and digital product optimizations based on an unlimited number of tasks, questions and test duration. Users can test on desktop, mobile, and tablet, create and share highlight clips and timestamped notes, and get UX metrics for faster analysis and insights.

Best for

Testing or gathering research on different designs or prototypes before making a decision.

8. Qualaroo

Qualaroo is a SaaS-based online survey creator, producing results its developers claim are 10x more valuable than email surveys. Embedded in websites or apps, Qualaroo surveys can target subjects based on their specific actions and behavioral patterns, making it easy to survey specific users while they’re directly engaged with a product, service or brand.

Specialisms

Specialist features include pre-built templates, multiple question types, advanced targeting options, customizable design, intelligent data mining, and multi-channel support. Qualaroo’s Nudge technology enables users to ask the right questions at the right time without being intrusive. Based on years of research, key findings, and optimizations, Nudge can learn a site’s structure to improve response rates over time.

Best for

Brands looking to gather quick, unobtrusive feedback on how a product functions and why customers like it.

9. Temper

Temper uses embeddable widgets – most notably the familiar “sad”, “neutral” and “happy” face clickable icons – to measure customer sentiment. The aim is to identify successes to build on – and shortcomings to improve – using feedback and evidence.

Specialisms

Temper has three modes that reflect its specialisms. In Tab mode it shows up at the bottom of every web page, helping businesses gauge how satisfied users are with an entire site. In Inline mode Temper is placed on specific web pages that businesses need to gather feedback on. Finally, in Email mode Temper is included at the end of emails, helping assess customer support interactions.

Best for

Brands that want to measure customer mood to spot frustrating experiences or highlight problematic areas of a site or product.

10. BrandMentions

By continually analyzing the most important channels on the web and social media, BrandMentions keeps users informed by monitoring online mentions of brands, competitors and people.

Specialisms

BrandMentions specializes in helping businesses get closer to their customers and key influencers. The result helps businesses acquire and retain customers, create products that meet their exact needs, and manage their brand reputation by always being aware of who’s saying what about their brand.

Best for

Brands who want an easy way to keep on top of brand monitoring, reputation management, and business Intelligence.

11. SurveyMonkey

SurveyMonkey describe themselves as “a global leader in free and paid online surveys”. Typical audiences include employees, customers and target markets, although SurveyMonkey works equally well for any group with an online presence.

Specialisms

SurveyMonkey’ specializes in collecting feedback, with over 300 sets of questions optimized for different survey types. SurveyMonkey Audience is a trusted panel of more than 175 million international respondents able to deliver international market insights in as little as an hour. SurveyMonkey Genius brings together AI, survey experts, and machine learning to develop survey intelligence.

Best for

Anyone without detailed survey experience or who’s time-poor, as everything is templated and therefore quick and easy to use.

12. Answer the public

AnswerThePublic is a free keyword generator tool that lets users see the questions and ideas people are searching for – making it great for any organization taking their first steps with market research. As they put it: “AnswerThePublic listens into autocomplete data from search engines like Google then quickly cranks out every useful phrase and question people are asking around your keyword.”

Specialisms

Users get three free searches per day, or they can upgrade to a Pro plan for unlimited searches. A useful pro-only specialist feature is Search Listening Alerts, which is a weekly email digest showing what new questions are being asked online around any topic.

Best for

Seeing what’s trending in organic search, so brands can build strategies and campaigns around the most important questions being asked on Google.

13. Make My Persona

Make My Persona is a free tool from Hubspot that’s essentially a buyer persona generator. It helps segment different types of customers a business wants to attract by clarifying key differences between groups within a target audience. As we’ve mentioned above, free is always great for any organization dipping their toes into market research.

Specialisms

Make My Persona specializes in creating and sharing avatars quickly and easily, enabling users to visualize key differences between groups within their target audience. In the process it clarifies each persona’s goals, challenges, and day-to-day responsibilities, highlighting ways brands can overcome their obstacles and simplify their workflow.

Best for

Getting a top level understanding of a brand’s audience for use as a springboard for ideas and/or more research.

14. BuzzSumo

BuzzSumo is a social media and content marketing tool that tracks media mentions, backlinks, and social shares. Used by thousands of businesses worldwide, BuzzSumo helps them create content, monitor their brand and industry, and discover growth opportunities.

Specialisms

BuzzSumo’s specialisms include sparking content ideas by browsing topics, trends and forums, content research by scanning billions of articles and social posts for insights, influencer identification by finding creators with engaged audiences on Instagram, Twitter and the web, and mentions, trends and updates tracking.

Best for

Competitor intelligence, helping brands see what works – and what doesn’t – to optimize their marketing activity.

15. Userlytics

Userlytics is a user experience (UX) and testing company that works with enterprises, governmental organizations, non-profits, agencies and startups to provide an all-in-one solution for remote user testing.

Specialisms

Userlytics’ specialisms include AI-based synthesis and analysis of qualitative sessions, sentiment analysis, and using invisible observers for moderated studies. Their seamless “no download, no extension, no multiple tabs” UX testing easily integrates with prototyping platforms like Figma or AdobeXD.

Best for

Testing, testing, and more testing, with multiple models from moderated, unmoderated and qualitative, to web usability, prototype and accessibility testing.

16. NielsenIQ

Nielsen rebranded its data and analytics branch in January 2021 as NielsenIQ (NIQ). Today NIQ helps clients understand consumer buying behavior and reveal pathways to growth. Full disclosure: GWI currently has a fusion with Nielsen as part of our GWI USA data set.

Specialisms

NIQ in partnership with GfK offers Full View, a solution designed to provide a complete picture of consumer buying behavior combined with omnichannel coverage, data platforms, and predictive analytics.

Best for

Brands that want to track shopping habits and purchase behavior, helping them understand what drives consumer activity across channels.

Last words on market research tools

The end is nigh; if you’re looking for a new tool to gauge consumer sentiment or run market research, then this article should get you off to a great start.

As we mentioned earlier, we think GWI is right up there with the best. But we would say that, wouldn’t we? So we’ll let you be the judge.

Market research tools and resources FAQs

How do you do market analysis?

Classic market analysis is a six stage process: research your industry, investigate the competitive landscape, identify market gaps, define your target market, identify barriers to entry, and create a sales forecast.

What are market research methods?

All market research can be split into two broad areas: primary and secondary, otherwise known as field and desk. Effective ways to do market research include focus groups, surveys, consumer research with social media listening, interviews, experiments and field trials, observation, competitive analysis, and using public domain data.

Can market research tools and resources be used for product development?

Certainly. Market research can help you understand users’ needs when developing new products, as well helping to identify potential risks and market opportunities. And while doing product development research, you could come across ideas that could improve other areas of your business.