You’ve probably noticed that marketing campaigns focusing on mental health are increasingly common – and it’s not hard to understand why. The pandemic upended everyone’s lives; add in a cost of living crisis, geopolitical instability, and environmental worries, and it feels like we just can’t catch a break.

That’s borne out in our data. For one, people are feeling the financial strain; nearly 1 in 4 global consumers expect their country’s economy to get worse in the next 6 months, while the number who say the same of their personal finances increased 13% between Q4 2021 and Q4 2023. On top of that, 1 in 5 millennials feel overworked, the highest of any generation as of Q1 2024, rising to 40% in Türkiye.

Then there’s our annual Connecting the dots report which takes a deep dive into the emerging consumer trends of 2024. One way or another, several of these trends are linked to consumers’ mental health and wellbeing, and what they’re doing to protect it. For example:

- Among Americans who believe social media damages their wellbeing, 48% say they often feel hopeless about the state of the world while using it

- Nearly 2 in 5 Americans think current events are one of the main contributors to poor mental health

- Amongst people with a mental health condition, 53% say AI development should be paused to ensure it’s safe

Against this backdrop, it’s no surprise that consumers around the world have made looking after themselves and their mental health a priority.

More and more brands are showing their support for mental wellbeing via ads and campaigns focusing on their customers, employees, or both.

Obviously this is a sensitive area that needs to be treated with a mix of compassion and courage. Let’s look at five examples of brands who’re doing it right.

5 mental health campaigns to know about in 2024

For most organizations, mental health campaigns aren’t about winning new business; instead they’re essentially reputation-building exercises intended to show that the brand in question knows what matters in life and has their priorities right.

That said, they can definitely be an effective way to build brand trust, with mental health campaigns giving brands an opportunity to speak from the heart and connect with consumers in an authentic way.

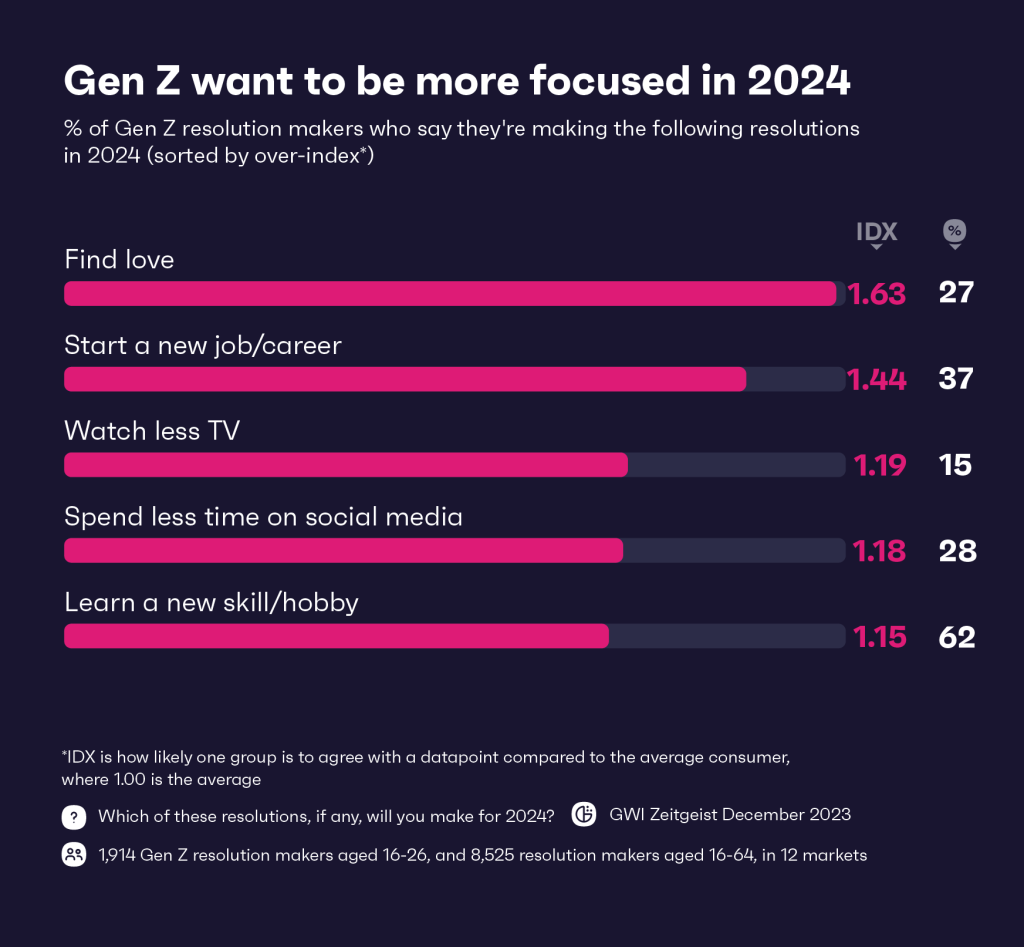

Our data shows this approach seems to work. Consumers, particularly younger audiences, tend to like these types of campaigns, with 28% of Gen Z in 12 markets saying ads should raise awareness of social or environmental issues.

So having set the scene, let’s dig into 5 mental health campaigns worth your attention.

Mind – “If this speaks to you”

Mind’s “If this speaks to you” mental health campaign aims to challenge the way we speak about mental issues and how we listen to others.

Each video in this ongoing series pairs an individual experiencing a mental health issue with an artist who creates and delivers a 30 second poem based on their story.

The format is a key part of the success of this mental health campaign; stripped back and impactful, spoken word is a powerful way to deliver a poignant message.

The numbers

In any given week in the UK, 1 in 6 people report experiencing a mental health problem like anxiety and depression. On a global scale, the World Health Organization estimates that 5% of adults suffer from depression.

According to our own data, 28% of Gen Zs, and 24% of millennials say they’re prone to anxiety. In the US, Gen Zs are disproportionately affected by depression; they’re three times more likely than Gen Zs anywhere else in the world to say they currently have a mental health condition, with 16% saying they currently experience depression.

The message

The core message of Mind’s “If this speaks to you” mental health campaign is simple: Whatever your experience, whatever your difficulty, it’s important to reach out for help.

The films show that even if someone feels alone and thinks “there’s nobody like me”, others are experiencing the same things and support exists. By sharing these real stories, Mind helps to normalize mental health issues and encourage people to seek support.

CALM – “Suicide doesn’t always look suicidal”

This simple but hard-hitting mental health campaign from the UK’s Campaign Against Living Miserably (CALM) reminds us that suicide is something that happens to ordinary people from all walks of life, and that – crucially – many don’t show any outward signs of distress.

To draw attention to this fact, CALM’s “Suicide doesn’t always look suicidal” mental health campaign uses the last home videos of people who took their own lives not long after they were filmed.

The individuals shown in this campaign look superficially cheerful which makes the campaign message all the more impactful. The result is intensely moving but incredibly necessary to raise awareness of people’s inner state.

The numbers

125 people die by suicide every week in the UK. CALM’s suicide prevention campaign highlights how difficult it can be to spot when someone is struggling and at risk of taking their own life.

The message

One of the key messages of the campaign is that CALM is there to provide people with the tools they need to start a potentially life-saving conversation. It also provides important information on signs that may show someone needs support, even if they seem happy on the surface.

Created for TV, this 90-second ad is so raw and emotive that it attracted criticism, with suggestions it shouldn’t be shown before UK TV’s 9pm watershed for content with distressing or adult themes. CALM responded, explaining the campaign was meant to be uncomfortable. As they put is, “Society’s standards around suicide need to be challenged and that was what the ad and their organisation intended to do”.

Dove – “The Real Cost of Beauty Ideals”

Body dissatisfaction is a public health crisis that can cost young people their health, their happiness – and even their lives.

In this campaign, Dove invites young people to share stories of how they’re affected by “appearance hate and discrimination” caused by toxic beauty ideals, with a wider mission is to make social media a more positive place that’s safer for kids.

The numbers

Dove launched their Campaign for Real Beauty nearly two decades ago, inspired by the heartrending fact that just 2% of women describe themselves as “beautiful”.

Fast-forward to 2023, and research carried out as part of Dove’s Self-Esteem Project showed 8 in 10 youth specialists believe social media is fuelling a mental health crisis – with a massive but largely hidden economic toll.

Partnering with Deloitte Access Economics and Harvard’s T.H. Chan School of Public Health, Dove’s rigorously researched report shows that each year in the United States, body dissatisfaction incurs as much as $84 billion in financial costs, with an additional – and staggering – $221 billion in loss of well-being.

According to Dove, nearly one-third of the financial costs of body dissatisfaction are borne by individuals/families (32%) and government (29%), while employers also pick up a sizable portion of the tab (14%). Regardless of who ultimately pays, body dissatisfaction is undoubtedly a critical issue that deserves wider attention.

The message

The Dove Self-Esteem Project is working alongside youth activists, researchers, experts, and like-minded organizations to build body confidence and fight toxic beauty ideals fuelling appearance hate and discrimination.

The message is simple but essential: we need to change beauty for the better by addressing harmful ideals that can have an adverse effect on self-esteem, mental wellness, and even limit an individual’s access to employment and educational opportunities.

Norwich City Football Club – “You Are Not Alone”

This mental health campaign video, made by UK Championship League side Norwich City FC to support #WorldMentalHealthDay and Samaritans mental health charity, addresses themes of suicide.

Like the CALM video we profiled above, it makes the point that sometimes it can be difficult to know when someone is struggling. The hard-hitting plot twist in the closing scene makes this point incredibly well.

The numbers

At the time of writing, the “You Are Not Alone” video has racked up a remarkable 55M views.

The use of male protagonists reflect the shocking statistic that in the UK, 74% of all suicides registered in 2022 (the most recent year for which the Office of National Statistics has data) were men, while one in eight men globally will experience a mental health issues at some point in their lives.

The message

Men’s mental health has long been an underrepresented issue – something that needs to change. Norwich City FC wanted to do this important topic justice by partnering with Samaritains to make sure they covered the subject matter in a relevant way. The message they arrived at is simple: check in on those around you. However isolated someone feels themselves to be, they’re not alone.

ASICS – “Personal Best”

As we mentioned at the start of this blog, it’s fair to say that recent years have put massive strain on the mental health of millions – maybe billions – of people worldwide. This situation inspired ASICS – one of the world’s leading sports shoe brands – to take action and create this mental health campaign.

Their aim is to encourage more people to experience the mental health benefits that movement can bring. That, in turn, starts with tackling the barriers that prevent people being more active. Just telling people to “start moving more” is unlikely to work; instead this campaign acknowledges that exercise can feel a bit intimidating at first, but with the right motivation and support it doesn’t have to stay that way.

The numbers

In 400 BC, ancient Greek physician Hippocrates wrote that, “Walking is man’s best medicine”. Note that he said “walking”, not running ultramarathons or taking up MMA.

His point is just as relevant today: moving doesn’t have to be hard. The UK’s NHS recommends low-intensity aerobic exercise as a reliable way to increase positive moods.

Similarly, the UK’s National Institute for Health and Care Excellence, suggests three sessions of exercise of around 45 minutes a week as one of the first treatments for mild to moderate depression.

The message

ASICS’ message in this video is ultimately about accessibility. A “personal best” is not how far you can run, how fast you can finish, or how many reps you can do; instead it’s about doing what’s best for you personally.

As they put it, “A personal best isn’t a number, it’s a feeling”, something that makes complete sense when you realize “ASICS” is an acronym from the Latin phrase “anima sana in corpore sano” or “a sound mind in a sound body”.

So for the sake of everyone’s mental health, ASICS is saying it’s time to make exercise more welcoming and to celebrate the benefit of exercise, not just on the body, but also on the mind.

What makes a good mental health campaign?

To round up this blog, let’s take a quick look at what all these mental health ads/campaigns have in common that makes them successful.

They’re authentic

Featuring real people, real stories, and real events, all of these mental health campaigns feel both genuine and sensitively executed. The authenticity is more than skin-deep: Mind worked directly with volunteers experiencing mental health issues, and CALM engaged with the families and loved ones of suicide victims, adding extra impact to these campaigns.

They’re guided by data

The best mental health campaigns draw attention to what’s happening right now, and they’re backed up by stats. When the story builds on actual insights, it’s much harder to go wrong.

For example, our data shows that younger people are typically more likely to experience mental health issues. Over 1 in 4 Gen Z and millennials say they are prone to anxiety, and a huge 82% of these same groups in the US say they would like to see more of a focus on mental health in healthcare.

They include a clear message and call to action

There’s a consistent message running through all the mental health campaigns we’ve covered here: we need to start talking about mental health, and no matter how bad someone feels, they’re not alone and help is available. This simple but impactful message can make all the difference.

This article has been updated to reflect its importance. Originally published in August 2019, it was refreshed in January 2023, and again in March 2024.

Useful mental health resources:

- World Federation for Mental Health (WFMH)

https://wfmh.global - MindEd, a free educational resource on children and young people’s mental health for all adults

https://www.minded.org.uk/ - Mental Health Foundation, support and research for good mental health

https://www.mentalhealth.org.uk - Mind, the mental health charity

https://www.mind.org.uk - YoungMinds, the voice for young people’s mental health and well being

https://www.youngminds.org.uk - Heads Together, a mental health campaign led by The Royal Foundation

https://www.headstogether.org.uk - Campaign Against Living Miserably (CALM), the suicide prevention charity – https://www.thecalmzone.ne

- SANE, a leading UK mental health charity

https://www.sane.org.uk - Samaritans, confidential support

https://www.samaritans.org - Optimale, on men’s health and wellbeing

https://www.optimale.co.uk/male-menopause-mental-health-guide/